38+ what percentage of income on mortgage

A front-end and back-end ratio. Web The Bottom Line.

Average Mortgage To Income Ratio For Different Income Quintiles Download Scientific Diagram

Web This refers to the recommendation that you should not spend any more than 28 of your gross income on the total amount you pay for your mortgage monthly.

. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including. Keep your mortgage payment at 28 of your gross monthly income or lower. Ideally youd spend 36 or less of your gross monthly income on all debts but there are.

Web According to this rule a household should spend a maximum of 28 of its gross monthly income on total housing expenses and no more than 36 on total debt. Web The 2836 is based on two calculations. Ad Mortgage Rates Are Constantly Changing.

House Bill 2526 would would initially cut. Web Percentage of income borrowed for mortgage. Ad Easier Qualification And Low Rates With Government Backed Security.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. What percentage of your household income goes toward your mortgage. Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28.

I have read 30 is around the desirable amount. Estimate your monthly mortgage payment. Web The Senate passed a compromise version of the long-discussed income tax cut bill during Saturday afternoons floor session.

Ad See how much house you can afford. Compare More Than Just Rates. Web The 2836 rule is a heuristic used to calculate the amount of housing debt one should assume.

Ad Easier Qualification And Low Rates With Government Backed Security. According to this rule a maximum of 28 of ones gross. Generally an acceptable debt-to-income ratio should sit at or below 36.

Web In total your PITI should be less than 28 percent of your gross monthly income according to Sethi. Were not including any expenses in estimating the. Web But nationally 53 of the average household income went on paying a mortgage on an average price property with a 20 deposit and a 25-year term in the.

Web Keep Monthly Costs Below 42 of Your Income. Veterans Use This Powerful VA Loan Benefit for Your Next Home. Ad Calculate Your Payment with 0 Down.

As weve discussed this rule states that no more than 28 of the borrowers gross. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and. Find A Lender That Offers Great Service.

Web The Percentage Of Income Rule For Mortgages Rocket Money Use These Charts To Quickly See How Much The Higher Mortgage Rates Will Cost You Free 38 Certificate. For example if you make 3500 a month your monthly. Keep all credit cards loans home insurance costs bank obligations mortgage principal and interest lower than 42.

Web A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192. Get Preapproved You May Save On Your Rate. Web Lenders prefer you spend 28 or less of your gross monthly income on housing expenses.

Keep your total monthly debts including your mortgage. Web Calculated debt ratio 3809 What is a Good Debt-to-Income Ratio.

Income To Mortgage Ratio What Should Yours Be Moneyunder30

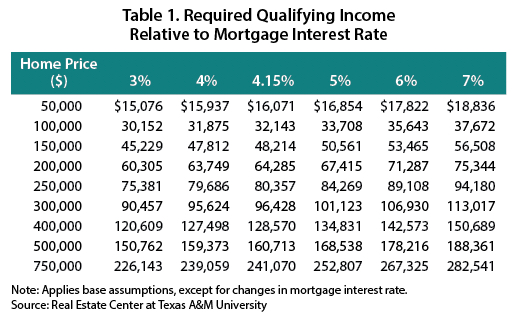

Article Real Estate Center

What Percentage Of Income Should Go To Mortgage

How To Find Out If You Can Afford Your Dream Home

Mortgage Income Calculator Nerdwallet

Income To Mortgage Ratio What Should Yours Be Moneyunder30

The Percentage Of Income Rule For Mortgages Rocket Money

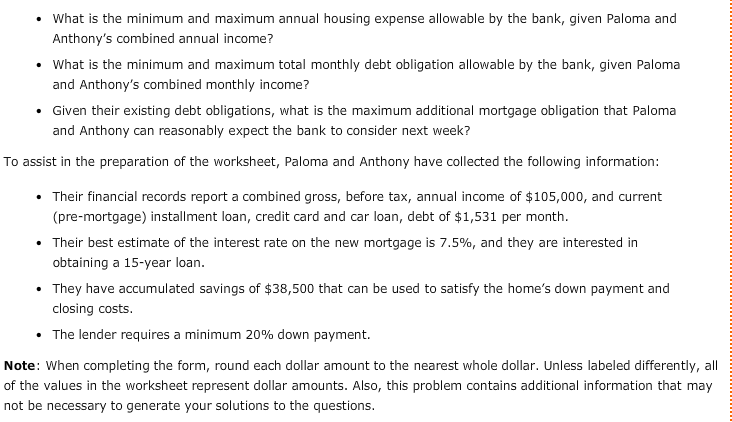

Solved First Filling The Blank A Back End B Front End Chegg Com

How Much Of My Income Should Go Towards A Mortgage Payment

What Percentage Of American Women Earn Over 100 000 Per Year Quora

What Percentage Of Your Income Should Go To Your Mortgage Hometap

Business Succession Planning And Exit Strategies For The Closely Held

How Much Mortgage Can I Afford Tips For Getting Approved For The Largest Loan Possible Investor S Business Daily

Here Are The Income Requirements For A Reverse Mortgage

Iof5jky2potkxm

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Mortgage Income Calculator Nerdwallet